The decision to deal with your debt can be life-changing, but only if you’re taking the right steps and following through with your repayment plan. Although finally deciding to face your debt may seem like the most difficult thing you’ve ever done, the hardest part comes next: avoiding mistakes. For many, dealing with debt is more than making a few extra payments.

The decision to deal with your debt can be life-changing, but only if you’re taking the right steps and following through with your repayment plan. Although finally deciding to face your debt may seem like the most difficult thing you’ve ever done, the hardest part comes next: avoiding mistakes. For many, dealing with debt is more than making a few extra payments.

Taking the right steps to deal with your debt involves learning how to budget, changing your spending habits, prioritizing, identifying your debtors, and much more. Whether you’re dealing with credit card debt, student loan debt, or anything in between, there’s hope for you. The process can be overwhelming, which is why we’re here to walk you through five steps to help manage your debt.

The First Step: Identify Who and What You Owe, and Why

The most important step in the process of dealing with debt is identifying who you owe, how much you owe them, and why. In order to properly identify who and what you owe, you need to make sure you know the creditor’s name, total balance, interest rate, minimum monthly payment due, and your monthly income. This information is crucial when organizing and conquering your debt, so make sure all of the information is correct.

After you have gathered this information, identify the reason for your debt. This includes being able to identify all purchases, loans, accounts, etc. as your own. It is important to do this because you may find some unrecognizable transactions that were not authorized by you, always keep an eye out for any indications of identity theft and fraud! Once you have covered all of the bases in step one, it is time to move on to step two.

The Second Step: Gather Your Data

The second step to take in order to deal with debt is to gather your data. Gathering your own data sounds simple, but be sure to take your time and be thorough. The data that you will need to gather is as follows: bills, statements, credit reports, and credit scores. For more information about credit scores, visit 1st Financial Bank USA’s article Credit Scores 101: A Beginners Guide.

During this step, it is important to make sure all of your statements and reports are correct and that there are no unidentifiable purchases or loans in your name. If you happen to encounter an error in your statements or reports it is important to contact your creditor immediately to solve this issue!

The Third Step: Make a Plan to Tackle Debt

Next comes step number three, making a repayment plan. By using the information you gathered in the previous steps, create a steady and realistic budget that you feel comfortable with. This budget should be based around your monthly income, expenses, total amount owed, and monthly savings.

In debt management, it is very important that you pick a method that works for you. Whether you start with the accounts with the highest amount, or those with the highest interest rate, it’s all up to you. Just remember that paying off the account with the largest amount, or smallest debt amount, isn’t always the best option for everyone.

Managing debt on separate accounts can be a hassle. Therefore, consider consolidating your debt when possible. When you consolidate your debt, you are essentially combining various accounts that are holding debt into one account with one monthly payment. This is a good way to simplify your monthly payments and stay organized, and it can possibly leave you with a lower interest rate.

Once you have organized, planned, and potentially consolidated your debt, you need to start paying more! Only paying the minimum payment isn’t enough to get you out of debt. By paying the largest amount you can every month you can speed up the process and avoid interest rates!

The Fourth Step: Earn More, Spend Less

The fourth step in your erasing debt journey is to earn more and spend less. If you have the time and are confident in your ability to handle more on your plate, consider picking up a part time job on the side.

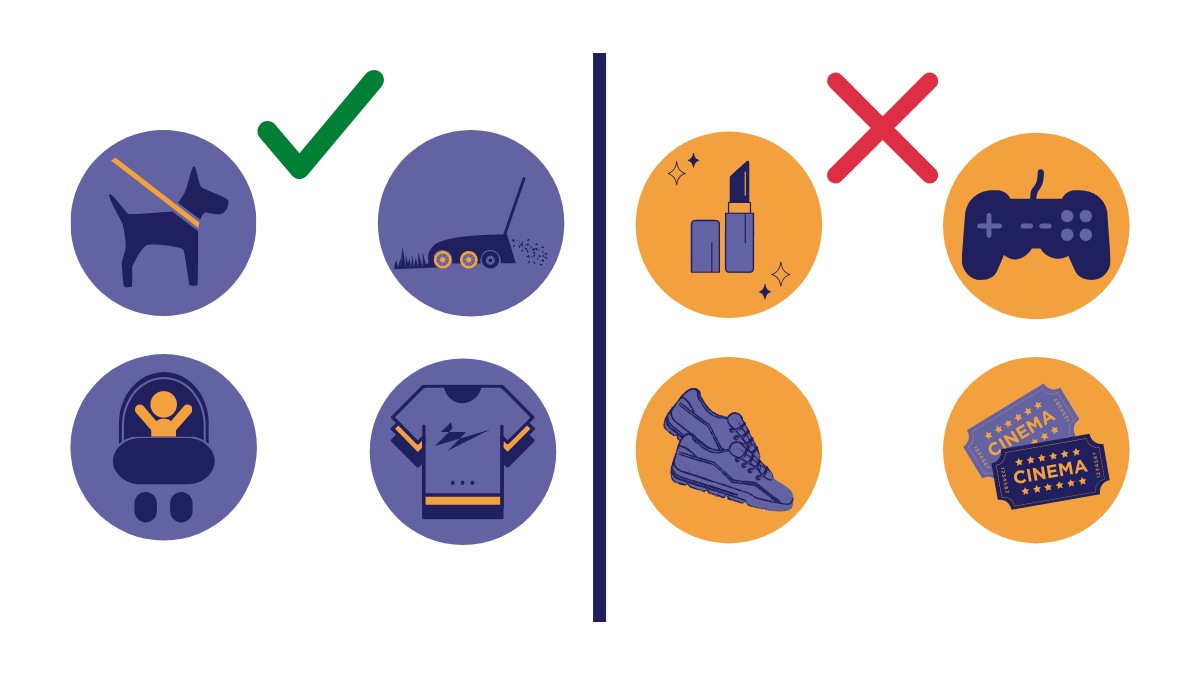

There are many side hustles and part-time gigs you can do to get some extra cash under your belt. Consider selling things that you don’t use, babysit, mow lawns, walk dogs, etc. You can put a listing on local websites for your side hustle of choice and watch as the requests come in. The second half of this step is spending less. This is crucial for saving money and erasing debt, you cannot spend like you used to.

Make an effort to avoid impulse buying; if you can live without it, then it can wait until you’ve paid off every penny. Before purchasing something that you may not need, wait a full week and think about it. A considerable amount of purchases are impulse buys, and you may no longer want it once the week is over.

The Fifth Step: Stick To Your Plan

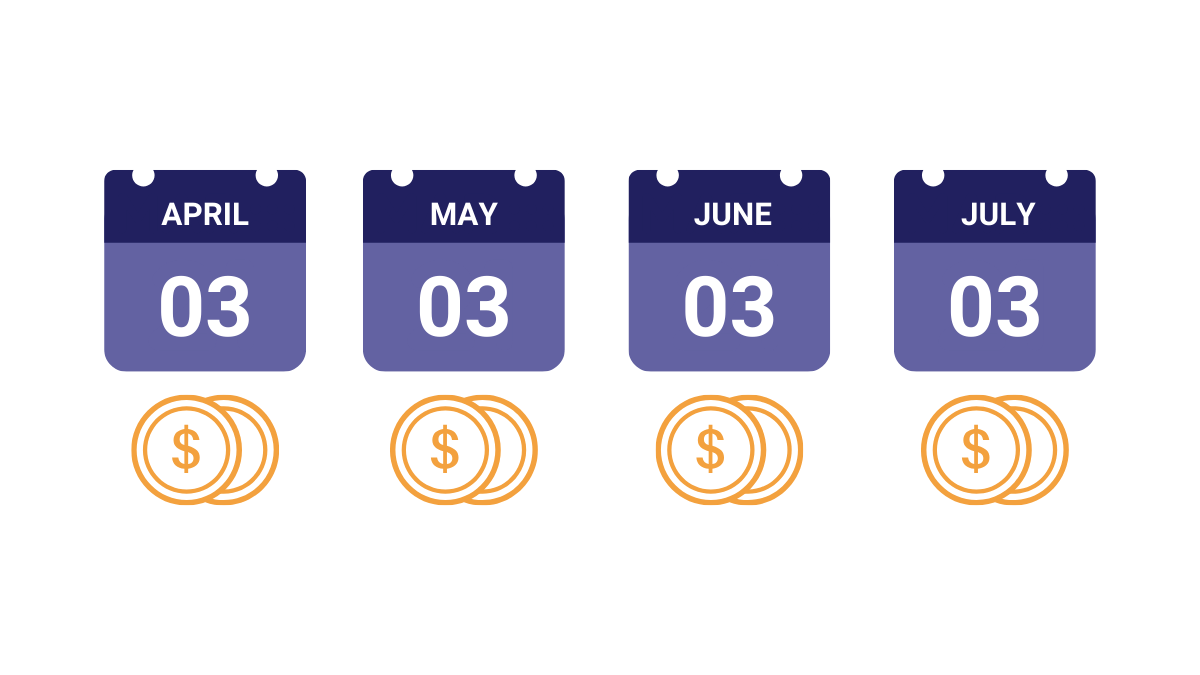

The fifth and potentially final step in your debt erasing journey is to stick to your plan. It’s important to consistently keep up with your debt. In order to avoid falling behind on payments, consider setting up auto-pay and commit to a specific amount each month.

It is important that you pay off as much as you can every month until your debt is paid off; the faster you clear it, the less interest you pay. The difference between taking six months and twelve months to pay off something can be hundreds to thousands of dollars in interest. Therefore, save yourself the time, money, and hassle by paying off your debt as quickly as possible.

One More Thing…

In the process of dealing with debt, mistakes can be crucial. It is important that you keep a keen eye and make sure you thoroughly cover every step. Here are a few mistakes to avoid while dealing with your debt.

- Reverting back to old habits

- Making an impractical budget

- Trying to pay off multiple debts at once

- Closing accounts when they’re paid off

- Stop saving in order to pay off debts

- Taking out of emergency funds

- Failing to verify credit reports

WHAT'S NEXT?💸Do you know how paying off debt fits into your budget? Find out in Budgeting 101 for College Students. 👍To learn more about credit scores visit Credit Scores 101: A Beginners Guide. |