Emergency funds are essential for everyone, but many people don’t know where to start. Ideally, your emergency fund should be able to cover at least 3-6 months worth of living expenses. However, the idea of having thousands of dollars set aside “just in case” is an expensive and daunting thought, and it can be very tempting to spend.

People may defend their lack of an emergency fund by saying they can’t afford to sift out several thousand dollars into a separate savings account. Others may say that there are more important things they need to spend money on, such as car repairs, credit card bills, and other products and services. While these things may be true for some people, you don't want to find yourself in a situation where you can't pay your monthly living expenses. Here's one easy way to start an emergency fund.

Think about it, how often do you spend at least $7 a day? At first the idea of setting aside $7 a day may seem like a tedious task, but think about it like this. Whether it’s a quick morning coffee or a gas station snack, almost all of us make some seemingly insignificant cheap purchase every day.

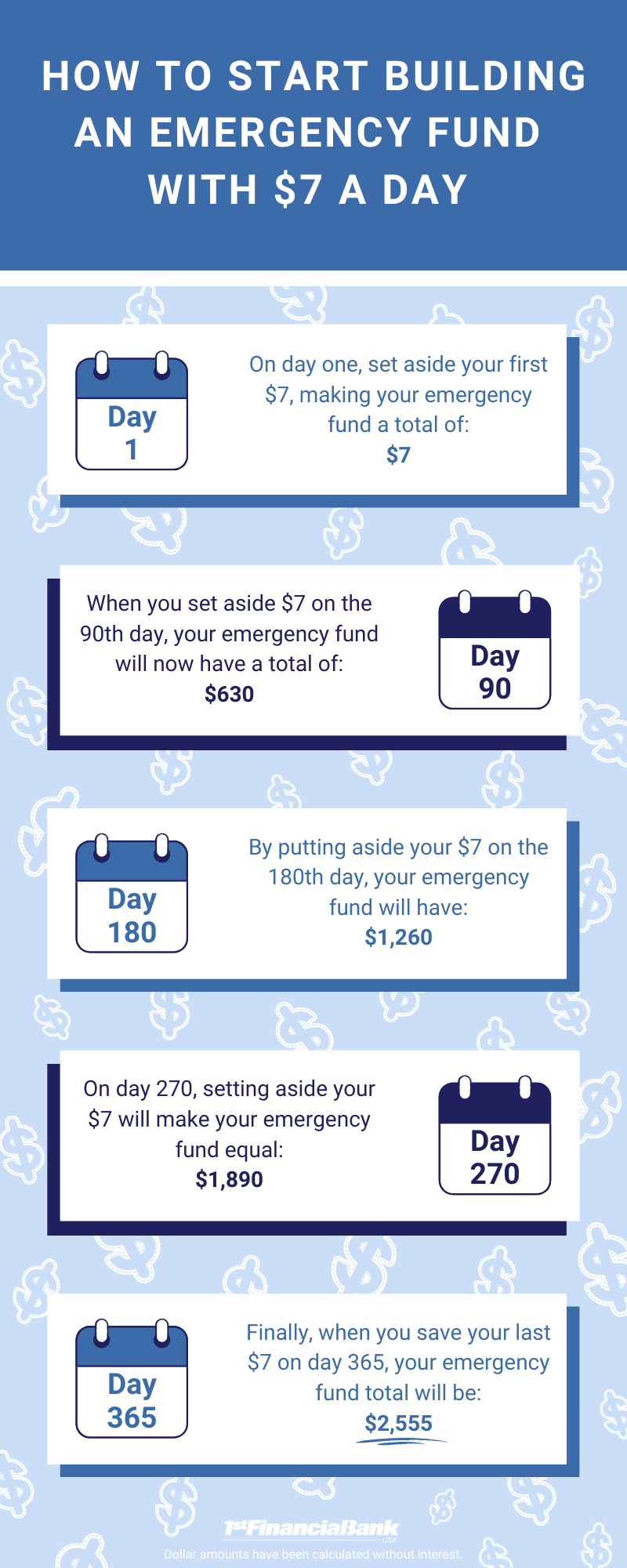

Now, what if you were to save this money for your future instead, or in addition to, your daily small purchases for an entire year? That’s a lot of money you could save and use to create a solid foundation in your emergency fund. Do we have our attention now? Take a look below to see how you could benefit from building your emergency fund with $7 a day.

There are many different ways you could kick-start your emergency fund. Some people prefer to set aside their tax refund every year, and others follow a savings plan. So, if you decided to follow our savings plan of $7 a day for a year, you could easily have $2,555, and that is without any interest.

If you were to set aside your daily $7 into a high yield savings account or a money market account, you would increase your total savings at the end of the year. To make it easier on yourself, you could also have the $7 be automatically transferred into your emergency fund account!

Now is the best time to get started and work towards your savings goal. Focus on getting your personal finances in order and creating a budget that works for you. You also need to set a goal; make sure it is realistic and attainable, you don’t need to stress about saving a thousand dollars overnight. The next step is to start saving! Remember, it can be as easy as $7 a day.

The information contained in this infographic and on the 1FBUSA Blog is for general informational purposes only and may not apply to you or your situation. You should not act or refrain from acting on the basis of any content presented on the 1FBUSA Blog without consulting your parents or professionals. We disclaim all liability for actions you take or fail to take based on any content provided on the 1FBUSA Blog website.

WHAT'S NEXT?🚨To learn what is an emergency fund and why you need one, read How Can You Plan For Unexpected Expenses? ⚖️Saving money isn't always the option for your finances. Read Paying Off Debt vs. Saving Money (How to Decide) to figure out the difference. |