Wouldn’t it be nice to receive your full hourly wage or salary without reductions? If that fantasy was a reality, there would likely be fewer people with budgets and more people with the ability to spend a greater amount of money without as much thought each month. Even with the help of a budget, it can be difficult to know where to direct your money. Before you decide what to do with your money each month, it must go through a series of reductions.

Wouldn’t it be nice to receive your full hourly wage or salary without reductions? If that fantasy was a reality, there would likely be fewer people with budgets and more people with the ability to spend a greater amount of money without as much thought each month. Even with the help of a budget, it can be difficult to know where to direct your money. Before you decide what to do with your money each month, it must go through a series of reductions.

Imagine your income like a whole pie. The first slice must go to the government in the form of taxes. Next, a slice goes to automatic deductions, such as 401(k) accounts or employer-sponsored insurance. As the transition from gross pay to take-home pay unfolds, some slices are served to all of your necessary expenses like food, rent, monthly bills, transportation costs, health necessities, or any other impending costs that must be paid first.

After those servings are taken out, you are left with the discretionary income pieces. These slices are considered your “fun money”. Remaining slices can go to your streaming services, clothing stores, and entertainment venues. These slices can be spent on vacations, your hobbies, or a gift for your grandmother. Finally, there is only one piece of the pie left.

Deciding where the last piece of the pie should go is rough. Many people are faced with the question: Should I pay off debt or save money? Read below to understand and recognize some of the indicators of how you should manage your debt and when you should place your money in a savings account.

When should I pay off debt?

Knowing when you should prioritize paying off debt can be difficult. Some circumstances regarding debt require your immediate attention. These situations include when you have debt with a high interest rate, multiple accounts with high amounts of debt, or an adequate amount of money in savings. Whether you have credit card debt, personal loans, or student loans, in the following circumstances you should focus on paying off the balances of these debts.

1. When You Have High-Interest Debts

Putting these debts as your first priority will save you money in the long run. For example, let’s say you bought a TV with a personal loan of $2000 with an 18% interest rate. If you made minimum monthly payments of $40, it would take you close to eight years to pay off that debt. The interest would cost you $1,724 in addition to the $2,000, which is almost what you paid for the TV in the first place. You can see the importance of paying back the loan before you started saving because the accrued interest would eat at your savings anyway.

2. When You Have Several Debts

Another situation when it would be wise to pay off your debts before prioritizing saving is when you have a lot of debts. These debts do not have to have a high interest rate for you to start caring about them. If you have several debt payments, you should try to decrease these debts as much as possible. Remembering the interest in the previous example, you can see that you would not want to have several debt accounts open that are accumulating high amounts of interest. If you cannot make a sizable deduction on these debts, contribute at least the minimum payments on each of these debts. Paying off debts, such as a credit card balance, can increase your credit score and could make you a candidate for lower interest rates on loans in the future.

3. When You Have Adequate Savings

Another situation when you should prioritize debts over savings is when you have already built up three to six months of emergency savings. It may not make as much sense to keep contributing to your savings account when your debt is spiraling out of control. As it was mentioned before, all of the money you would be saving up eventually goes toward the interest of the debt that was not paid off sooner.

When should I save my money?

Paying down debt is an important step in improving your financial health. However, there are times when your focus should be on savings instead. Some of the situations when you should serve the last piece of the pie to savings is when your place of employment offers a match for retirement savings, when you have a few low-interest debts, or when you have not yet started an emergency fund.

1. When Your Employer Offers Retirement Matching Services

Some employers offer 401(k) matching services. This means that the employer will set a percentage to which they promise to match the funds that you put in. For example, if you put 3% of your salary into your savings for retirement, your employer would put an additional 3% into your account. Not putting in the maximum amount of money that your employer will match is essentially throwing away free money. You should learn more about 401(k) retirement plans to make a better-informed decision about this in the future.

2. When You Have Only Low-Interest Debts

If you have only a few low-interest debts, it is beneficial to make payments on those debts as you normally would. The leftover amount should go directly to savings. Sometimes the interest it costs to take out a loan is more than the interest you earn when you place your money in a savings account. Make the most out of these situations by saving as much as you can.

3. When You Don’t Already Have an Emergency Fund

If you do not have a rainy day fund, a fund for unexpected expenses, or even just a little bit of extra pocket change, welcome to an emergency fund. Whatever you call your emergency fund, it serves the same purpose. That purpose is to protect you from an expense you did not expect to have to pay, like if your smartphone shatters or your car needs a pricey repair. Everyone should have three to six months of their monthly income saved up for these circumstances. If you do not already have an adequate amount of savings, you should focus your money and energy on developing that emergency fund.

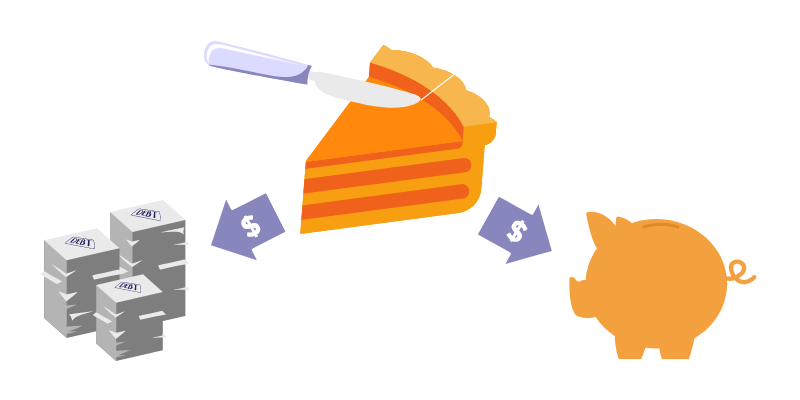

The Ultimate Solution: Both

There is no law saying you cannot cut your piece of pie. You can distribute it how you want. The piece of the pie that is left (your discretionary income) does not have to be given to only paying off debt or only savings. The best part of this remaining income is that the ratio of paying off debt to saving money is customizable to fit your needs.

Take into consideration your amount of debt vs. need for savings if you do decide to fund both. For example, if you happen to have high-interest debt, but need to contribute some money to your retirement account, consider a 60-40 split. If you don’t already have an emergency fund, but you are looking to pay off a lot of low-interest debt, consider a 70-30 split. The situations and possibilities are endless, so make sure to do what is right for you.

Whether you are faced with a mountain of debt or a pebble of savings, you now know what to do in each situation. As long as you remember to decrease your debt (instead of adding to it) and increase your savings (instead of depleting it), you will be on track to becoming the best money manager you can be. So although it is not possible to receive your hourly pay and salary without some reductions, it is possible to keep increasing the size of the slice of pie that is left over. The bigger your remaining slice of pie, the more money you have to do with as you please, and that sounds pretty sweet!

WHAT'S NEXT?💪Ready to take control of your debt? Read How to Manage Your Debt in 5 Easy Steps. 💰Curious to read more on savings? Take a look at 6 Smart Ways to Save for Your Future. |