.jpg) Having a budget is important at any age, but it is especially helpful in college. With new freedoms, activities, and opportunities, it’s easy to overspend without realizing it. A budget can keep you accountable, reminding you that you don’t need to order another pair of shoes this month, even if there was an “amazing sale”. Plus, tracking your income and expenses now will help you manage your money better in the long run.

Having a budget is important at any age, but it is especially helpful in college. With new freedoms, activities, and opportunities, it’s easy to overspend without realizing it. A budget can keep you accountable, reminding you that you don’t need to order another pair of shoes this month, even if there was an “amazing sale”. Plus, tracking your income and expenses now will help you manage your money better in the long run.

Before getting started, you will need to download and print the monthly budget template and expense tracker. You’ll use the templates to follow along with the steps below. While they’re printing, read further to learn about the different types of expenses, how they impact your budget, and the steps you need to create a college budget that actually works.

What are the types of expenses?

One way to separate your personal finance expenses is into fixed and variable categories. It’s important to identify the differences between these expenses when creating your monthly budget as a student.

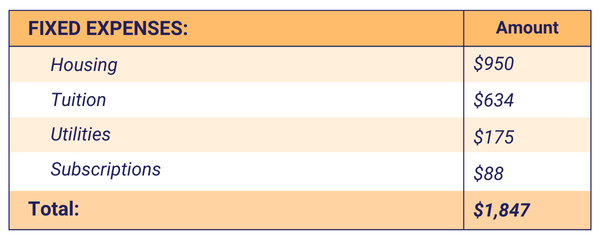

Fixed expenses

A fixed expense is a cost you pay regularly that typically stays the same amount. These expenses might be due weekly, monthly, quarterly, or yearly. Common fixed expenses for college students include rent, a meal plan, insurance, subscriptions, and car payments. The set amount you pay each month towards student loans or credit card debt can also count as a fixed expense.

Most fixed expenses are necessities, meaning you need them to get by. However, some fixed expenses are non-essential. For example, a streaming service might cost $10 per month. Even though the price stays the same, it isn’t something you need to survive, which makes it a fixed non-essential expense. Utilizing student discounts or splitting with roommates can help lower the cost of these monthly expenses.

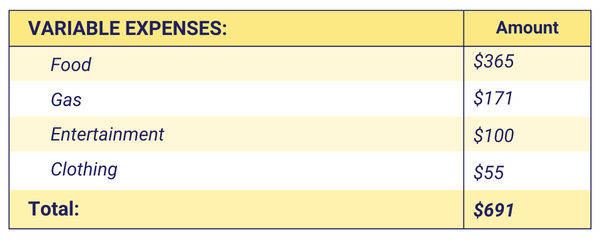

Variable expenses

A variable expense is a cost that can change from month to month based on how much you use or spend. Examples of variable expenses include gas, groceries, car maintenance, and your phone bill. For example, if your phone plan charges based on usage, a month that you make 10 calls will cost less than a month that you make 35 calls. Essentially, variable expenses will increase or decrease depending on your spending habits.

You need some variable expenses to live such as groceries. But just like fixed expenses, there are some that are not essential. These “optional” expenses are usually where extra spending happens. Things like concerts, movies, eating out, games, and vacations can be fun and add value to your life. However, their costs vary, and they aren’t necessities. Finding the right balance between enjoying these extras and saving for the future is an important part of managing your budget.

Creating your budget

Now that you’ve learned about the different kinds of expenses, you’re ready to establish your budget. You’ll need your budgeting worksheet and a calculator. You will be following along with the steps while customizing the budget sheet to your own lifestyle.

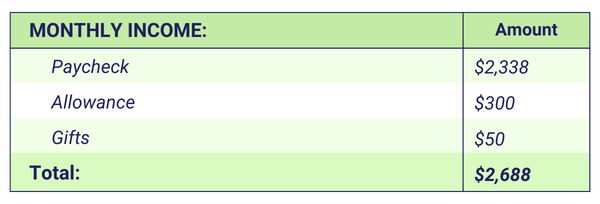

Step 1: Determine monthly income

Your income will give you insight into what you can spend each month. To find your monthly income, add up the money you expect to earn in the coming month. Be sure to include any income from your part-time job, work study, side hustle, allowance, or any monetary gifts; it’s important to keep track of everything!

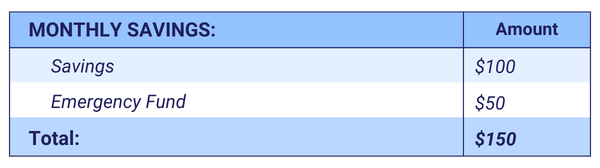

Step 2: Pay yourself first

After calculating your income, decide how much you want to save each month. Instead of saving whatever is left over, save as soon as you get your paycheck. You can treat savings like a fixed bill by setting aside a predetermined amount for your bank account or emergency fund each month. Automating this transfer can make it easier to stay consistent and to be better prepared for unexpected expenses. Make sure to write what you save in the “Amount” column and add up your total monthly savings.

Step 3: Calculate fixed expenses

Once savings are set aside, you can see what’s left for expenses. The next step is to calculate and write the cost of your fixed expenses in the amount column. Then, add them together to find your total fixed expenses. Because these expenses don’t change much, they’re typically easy to plan for and help you understand how much of your income is already accounted for.

Step 4: Estimate variable expenses

Take a look at your bank and credit card statements to get an idea of your variable spending. To keep your budget simple, you may want to group similar expenses into broad categories. For example, instead of entering snacks, coffee, groceries, and restaurants separately, you can list them all under “food”. Write down an estimate of each variable expense’s monthly cost. Then, add them together to find your total variable expenses.

Step 5: Adjust for zero-based budget

After you’ve listed your income, savings, fixed expenses, and variable expenses, make sure your budget is balanced. A zero-based budget means every dollar of your income has a purpose, whether it goes towards savings, financial goals, or living expenses. With this type of budgeting, your income minus all of your expenses should equal $0. This doesn’t mean you need to spend all of your money, just that every dollar has a job.

If you have leftovers after divvying up your earnings, decide where it should go. You may build your emergency fund, put more towards student loan debt, or increase a spending category that feels too tight. If your expenses are higher than your income, look for areas to adjust, such as reducing your non-essential variable expenses. The goal is to create a realistic plan where your money is fully accounted for and fully aligned with your priorities.

Following your budget

Creating your budget is usually pretty simple, but actually sticking with it is the difficult part. We created a monthly expense tracker to help you know where you’re at in real time with the budget categories you set. You’ll need your expense tracker and a pencil, but unlike the budget sheet, this expense tracker cannot be completed right away. You’ll need to monitor your expenses over the next month.

![]()

Track your spending

When you make a purchase, record the date, description, category, and cost. While it may seem simple, actively tracking your expenses can be eye-opening. You may be surprised at how quickly your spending adds up over the next month.

Make time to review

One of the best student budgeting tips is to set a dedicated time to review your budget. Whether it’s after every week, every paycheck, or every month, it’s good to check in with your expenses before you run out of money. Making adjustments to your spending and savings will help you stay on track with your long-term financial goals.

Eliminate impulsive purchases

If you notice you’re overspending in any categories, it might be due to impulsive spending. It’s important to recognize your triggers before you make any spending decisions. Having a waiting period of 24 hours or shopping with a list can help you scale back on impulsive purchases.

Prioritize your financial goals

In college, it’s easy to compare yourself to your classmates or friends, but your finances are personal. When you start to feel financial peer pressure, take a step back. Instead, focus on what matters most to you and what aligns with your financial priorities.

Celebrate your progress

You can keep your budgeting motivation high by rewarding yourself for meeting your goals. For example, if you meet your $1,500 savings goal before spring break, go out for ice cream with a friend. Be careful not to let your celebrations get too extravagant though, as they can quickly throw off your budget.

By following these tips and templates, you’re on the right track to keeping your monthly budget in check. We hope these steps help you to stay organized and save money as a student. If you find that you’re having a hard time sticking to the budget you set for yourself, consider another budgeting tool; follow the 50/30/20 rule or download a budgeting app. However you decide to budget, you should start today. Your future self will thank you!

WHAT'S NEXT?😎Have your budget in check? Read these Best Financial Tips for College Students. 💸Saving for something in particular? Check out What You Need to Know About Sinking Funds. |

.jpg)