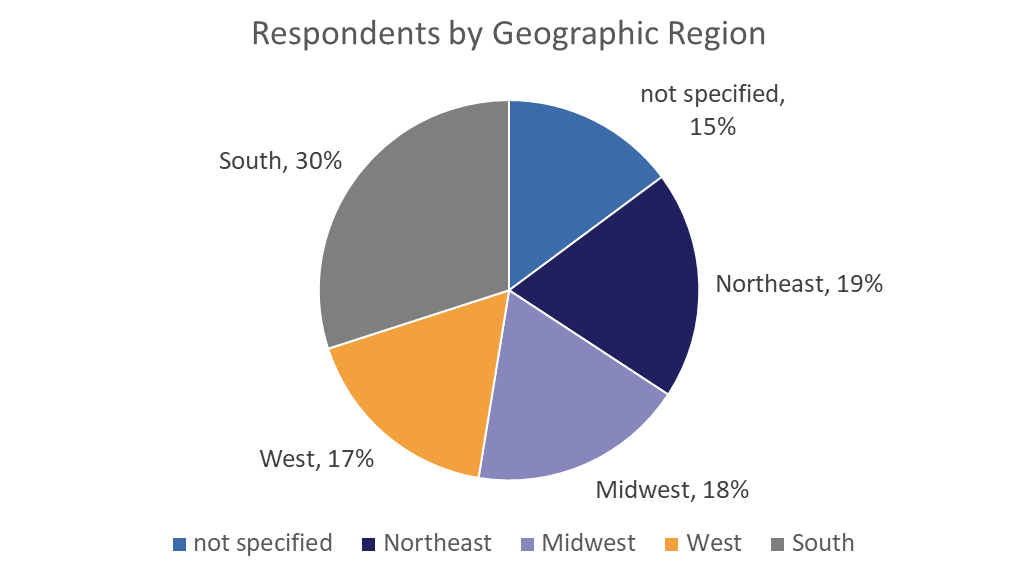

In the Fall of 2020, 1st Financial Bank USA surveyed 1,000 students across the United States to learn their opinions on student finance. 1st Financial Bank USA (1FBUSA), a member of the FDIC, has been providing quality community banking services in South Dakota for over 110 years. 1FBUSA also offers credit cards and other financial services to college students and college graduates, as well as home construction loans to builders, nationwide.

In the Fall of 2020, 1st Financial Bank USA surveyed 1,000 students across the United States to learn their opinions on student finance. 1st Financial Bank USA (1FBUSA), a member of the FDIC, has been providing quality community banking services in South Dakota for over 110 years. 1FBUSA also offers credit cards and other financial services to college students and college graduates, as well as home construction loans to builders, nationwide.

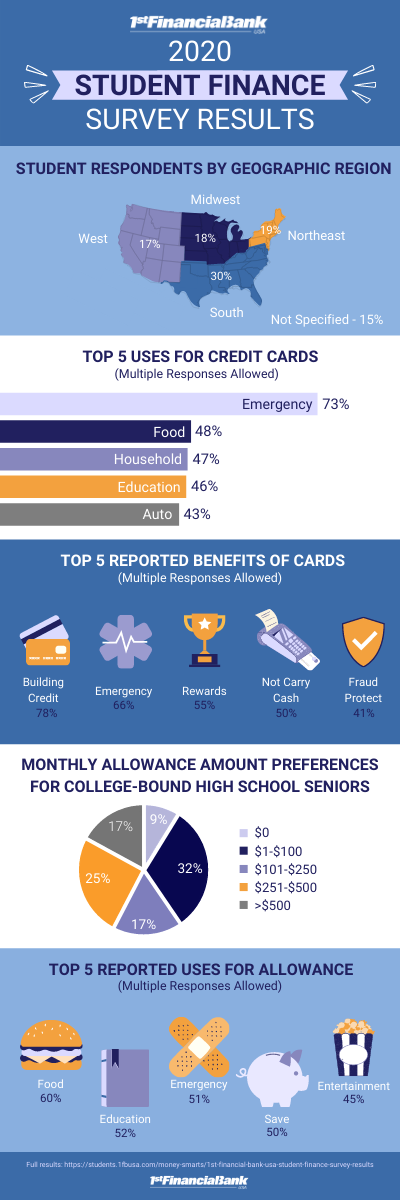

Below are the results from the student finance survey.

What should a credit card be used for?

A credit card allows individuals to borrow up to a certain amount of money from a credit card issuer - a bank, known as a credit limit, and then use that money to purchase goods and services. Credit cards can pay for educational, gas, food, and other expenses. The borrowed money must be repaid to the credit card issuer by a monthly due date with as little as a minimum amount of their balance owed (the “minimum payment due”) or as much as the amount owed in full. Paying the full balance each month by the account’s due date generally enables cardholders to avoid paying interest or late fees and accumulating credit card debt.

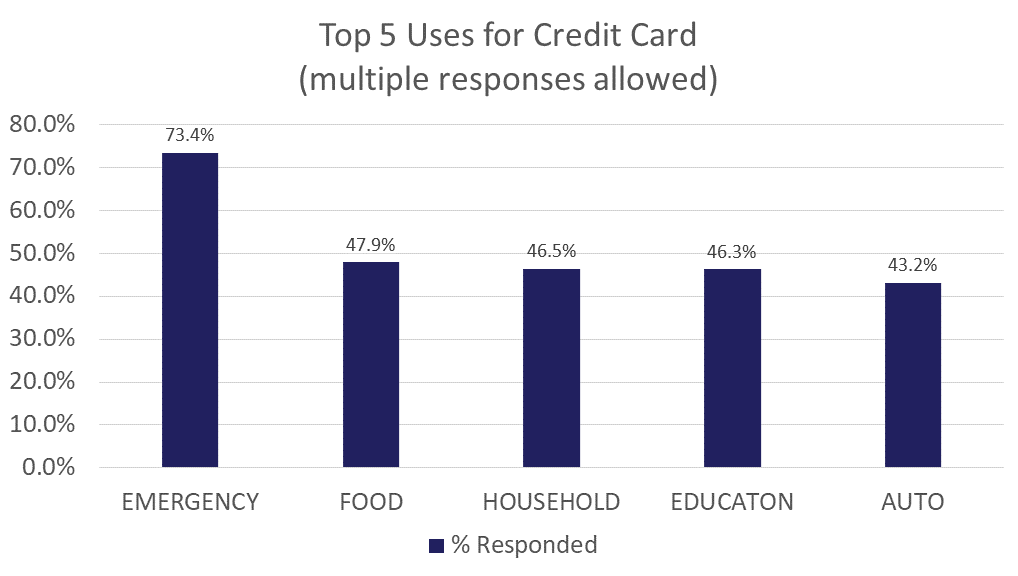

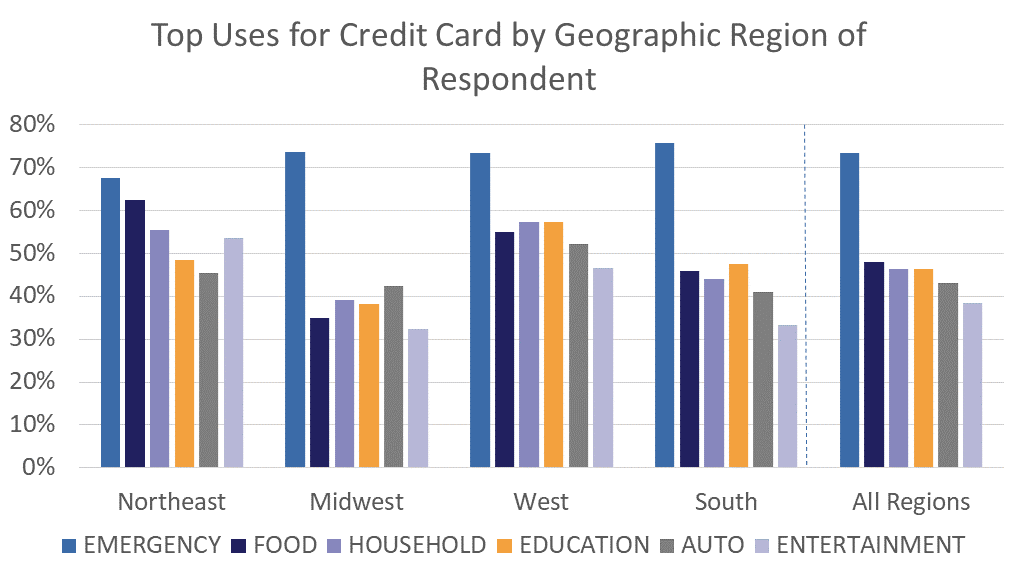

We asked students to share how they believed a credit card should be used from the following options: emergency, food, household, education, auto, entertainment, large purchases, travel, health/fitness, or none of the above.

Our survey found that emergency was the most popular category for the use of a credit card in every region of the USA by a large margin. Following emergency, the other top uses for a credit card in descending order were food, household, education, and auto.

Although there was a clear nationwide winning use, students were split when it came to choosing the remaining four categories. Besides emergency, the top category of each region is as follows: Northeast, food; Midwest, auto; West, education & household; and South, education.

What are the benefits of having a credit card?

Credit cards come with many benefits. Not only do they provide cardholders with fraud protection and the ability to carry less cash, but they can also help individuals develop responsible money management habits and build a good credit history. The opportunity to build credit is one of the most important benefits of a credit card. Cardholders who borrow only a portion of their credit limit and make monthly payments on time will generally build their credit. Having good credit is important in order to purchase a car with favorable car loan rates, rent an apartment during or after college, and even to help find future employment and become a home owner.

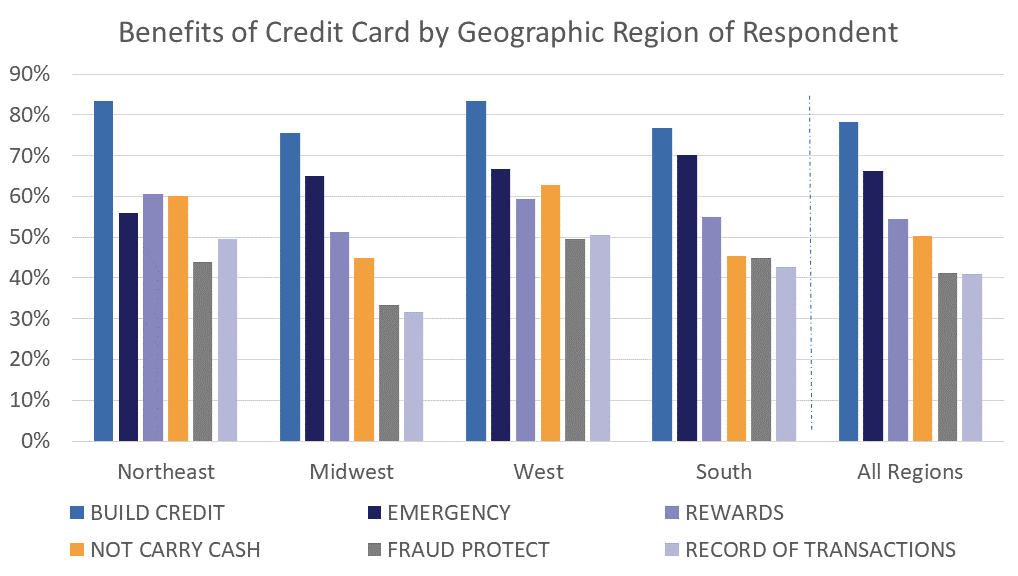

We asked students to select the benefits of owning and using a credit card from the following options: build credit, emergency, rewards, not carry cash, fraud protect, record of transactions, help manage budget, transaction speed, cash advance, or none.

The survey showed the reported benefits of credit cards to have a clear leader: build credit. The data shows that all regions think the main benefit of a credit card is to begin building new credit or improving your existing credit. Respectively, the following list represents the importance of the benefits after build credit: emergency, rewards, not carry cash, fraud protection, and record of transactions.

Once again, the regional differences stand out. The Midwest, South, and West all concluded that having the credit card in an emergency was the second top benefit. This mimics the top response to the previous question, which was also emergency. It’s clear that students believe credit cards are a helpful tool if something unexpected were to happen.

For the Northeast, emergency was selected as the fourth ranking benefit, as students in this region deemed rewards and the ability to not carry cash to be more important benefits.

.png)

What do you think a college-bound high school senior’s allowance from their parent(s) or guardian(s) should be?

Some students receive a monthly allowance from their parents when they go to college. An allowance can provide extra to help with bills, groceries, or other expenses.

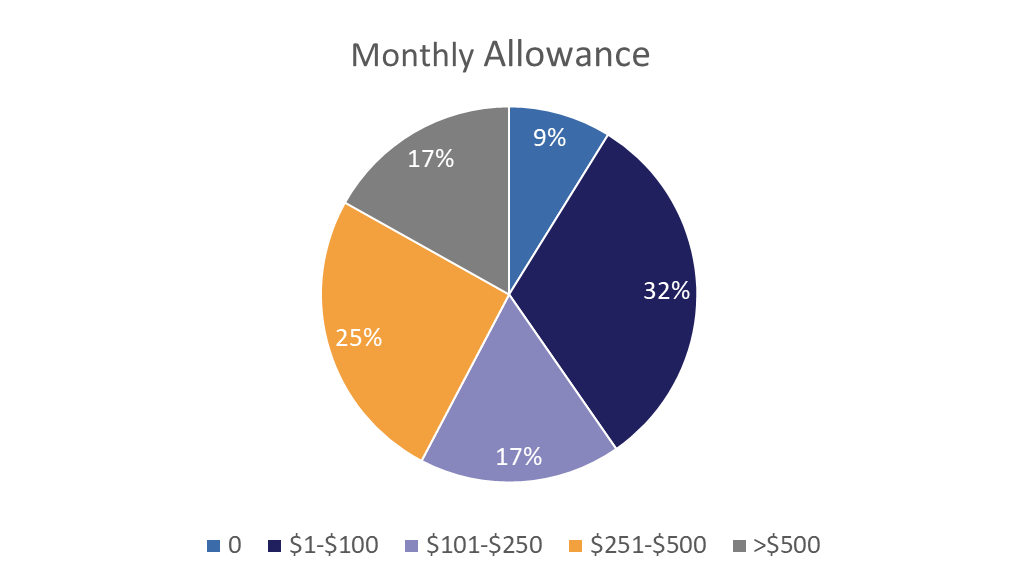

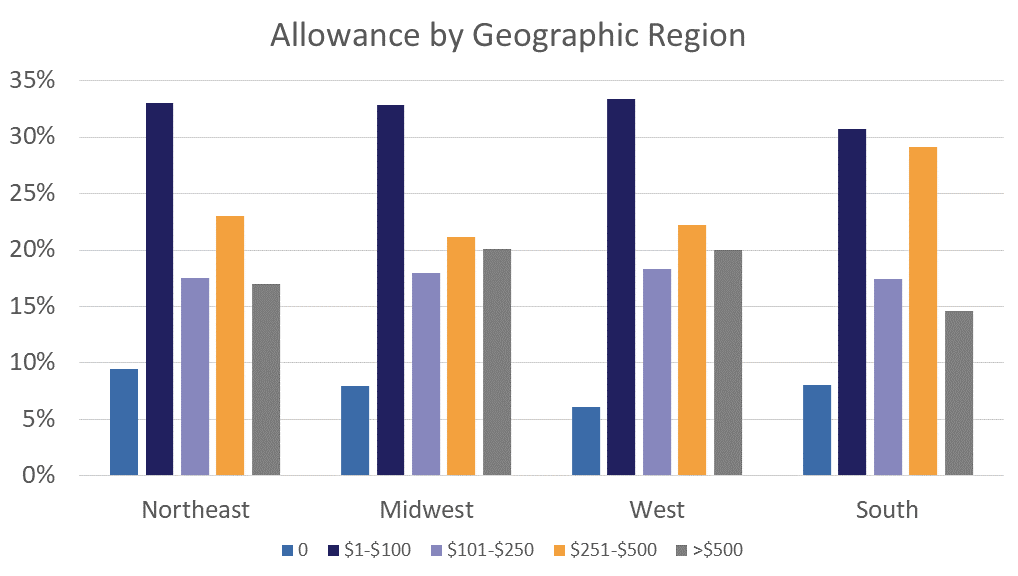

We asked students to select an allowance that they think a college-bound high school senior should receive from their parent(s) or guardians(s) by choosing a dollar amount per month from the following options: $0, $1-$100, $101-$250, $251-$500, >$500

Many of the people who completed the survey thought that a monthly allowance was necessary. With the regional results combined, $1-$100 came out as the monthly allowance victor. Second, students thought an allowance of $251-$500 was an appropriate amount to give college-bound seniors. Tying for third was the maximum allowance of >$500 and a moderate amount, $101-$250/month. Rounding out the monthly allowance survey, $0 was the least favored.

The top category in every region was the same with the majority of respondents selecting $1-$100 as their top choice. In addition, all regions were in agreement on the second choice for monthly allowance, which was $251-$500, and the least popular monthly allowance, which was no allowance at all.

The third and fourth allowance categories are where the regions split. The South and the Northeast favor >$500 every month over $101-$250, while the Midwest and the West value just the opposite.

How should a college-bound high school senior’s allowance from their parent(s) or guardian(s) should be used?

Receiving an allowance can be very beneficial to students in various situations. It can help them save for larger expenses or provide assistance with paying for everyday expenses. Some students may choose to spend some of their allowance on items considered less essential, like entertainment.

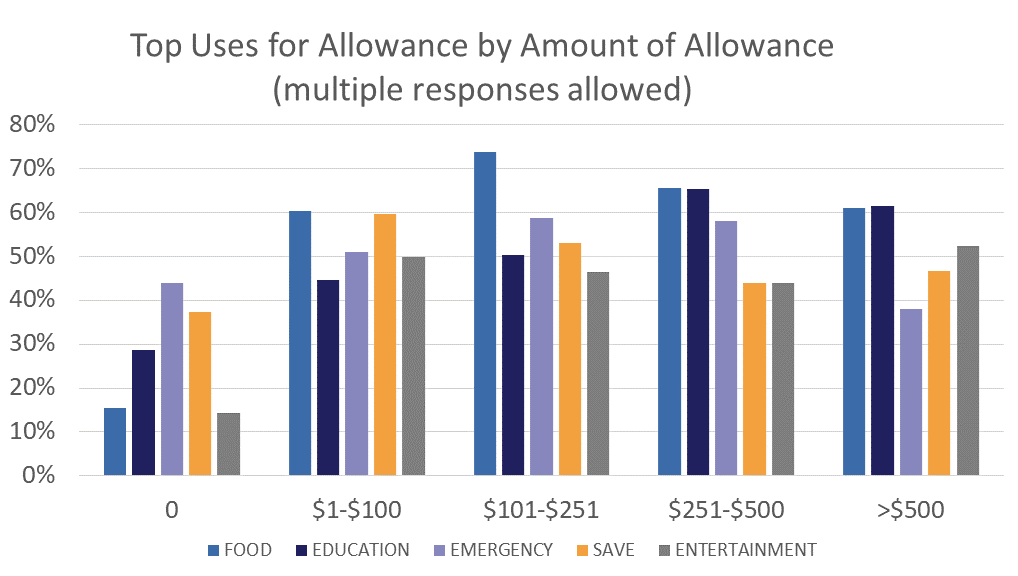

We asked students to select how they believe an allowance from their parent(s) or guardians(s) should be used from the following options: food, education, emergency, save, entertainment, household, travel, or other.

There is a national preference for the top reported use of allowance, but unlike the previous three sections, this section’s findings are grouped by allowance amount, rather than region. The results of this survey found the rank of the most popular uses for an allowance to be as follows: food, education, emergency, save, and entertainment.

As you recall, the most popular allowance category was $1-$100. The individuals who chose that category decided that money should be used for food and savings, following closely behind was emergency and entertainment. The group with the $1-$100 allowance found education to be the lowest priority.

Some respondents believed that no monthly allowance should be given to a college-bound senior. However, they responded to what they believe an allowance should be used for, if it is to be given. Their opinion was that it should go to responsible activities, with emergency, savings, and education being the most important categories.

The various allowance amounts had little to no correlation with top reported uses for an allowance.

.png)

If you have any suggestions on questions to be included in future student surveys from 1st Financial Bank USA, please send a private message via Facebook.

Download 2020 Student Finance infographic

WHAT'S NEXT?😎Do you like learning about your finances from people your age? Take a look at 10 Pieces of Financial Advice for College Students. 🍇Your trip to the grocery store doesn't have to break the bank. Read How to Save Money on Groceries. |

.jpg)

.jpg)

.jpg)