In high school, having a budget may take a backseat to completing your homework assignments, participating in extracurriculars, volunteering in your community, or applying to college. While budgeting might not be critical to your daily routine as a high school student, learning how to manage your personal finances is a skill that will be important for college life and beyond. Keep reading to learn more about budgeting and to download our free printable budget worksheet.

In high school, having a budget may take a backseat to completing your homework assignments, participating in extracurriculars, volunteering in your community, or applying to college. While budgeting might not be critical to your daily routine as a high school student, learning how to manage your personal finances is a skill that will be important for college life and beyond. Keep reading to learn more about budgeting and to download our free printable budget worksheet.

What is a budget?

A budget is a tool to help you manage your money. When you create a budget, you’re creating a financial plan for your income and expenses over a specific period of time. Some people may think of a budget as limiting, but it actually provides insight into your spending habits and helps you understand where your money is going. Common budget categories include housing, utilities, groceries, transportation, entertainment, and savings. However, your budget is highly customizable and can be tailored to the unique expenses of your own lifestyle.

Budgeting questions to help you get started

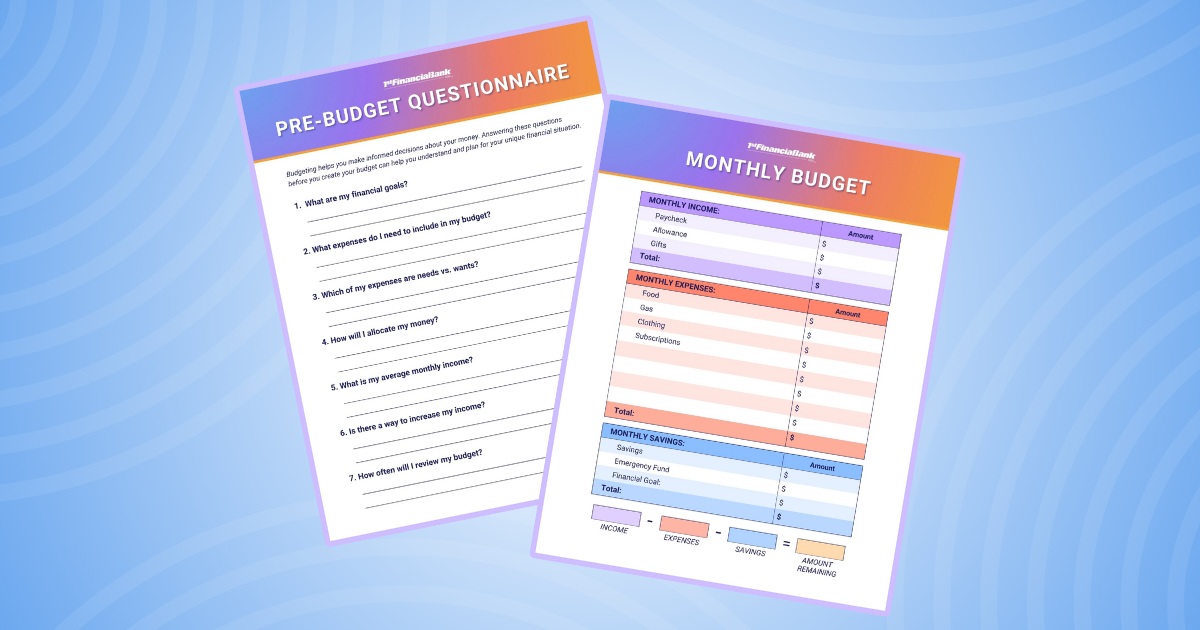

While budgets are beginner-friendly, the information needed to make your budget doesn't just appear out of thin air. You have to ask yourself questions about your current financial situation, spending tendencies, and money goals. Read the questions below and download our Pre-Budget Questionnaire to get in the right money mindset.

1. What are my financial goals?

In high school, you may have short-term financial goals, such as opening a savings account, saving for prom attire or a class ring, or starting an emergency fund. Some examples of long-term financial goals could include saving for a down payment on a car or adding to your college fund.

2. What expenses do I need to include in my budget?

When calculating your expenses, you should include anything that you’re expecting to spend money on. In high school, your expenses might be club dues, school supplies, food, and transportation. In college, your budget categories might expand to include tuition, room and board, personal hygiene items, entertainment, and more.

3. Which of my expenses are needs vs. wants?

Needs are expenses that you must have, like groceries, housing, insurance, or transportation. Wants are expenses that aren’t a necessity but make life more comfortable or fun, like streaming services, a name brand sweatshirt, concerts, etc.

4. How will I allocate my money?

If you don’t know where to start, a good rule of thumb is the 50-30-20 budgeting rule. This rule states that you should allocate 50% of your monthly income to your needs, 30% to your wants, and 20% to savings.

5. What is my average monthly income?

You can determine your average monthly income by adding up your income for three months and dividing it by three. This method still works if your income varies each month due to fluctuating work hours during the school year.

6. Is there a way to increase my income?

In situations where you cannot decrease your expenses, you can try to increase your income. You can make more money by adding a side hustle, starting a business, working more hours, or selling some of your old stuff.

7. How often will I review my budget?

Because a budget is dynamic, you need to check on it often. It’s recommended that you revisit your budget at least once each month, but there is no penalty for reviewing it more often.

5 simple steps to create a budget

Budgeting is a great life skill to develop, and learning to create one is one of the first steps toward increasing your financial literacy. It’s fairly simple if you follow the steps outlined below.

1. Record your income

The most common place to start when you are beginning to budget is to determine how much money you have coming in each month. In other words, you should add up your monthly income from all sources, including a part-time job, your allowance from parents, or a simple side hustle.

2. List your expenses

Next, you should determine how much you’re spending each month. These expenses could be fixed expenses (rent, tuition, insurance) or variable expenses (groceries, eating out, entertainment).

3. Set realistic financial goals

After totaling up your income and expenses, you should figure out what your money goals are. Whether it’s a short-term goal, like saving an extra $350 by Thanksgiving, or a longer financial goal, such as paying off your student loans, having clear objectives will act as a guide for your budget.

4. Track your spending

It’s not enough just to set your budget categories and forget about them. You should also monitor your expenses using receipts, bank statements, or a budgeting app. Tracking your expenses can help you identify spending patterns that you didn’t know existed and areas in your budget where adjustments can be made.

5. Review regularly

Take time each month to review your budget to check on your progress and make any necessary adjustments. As you get older, your financial situation or priorities may change, so it’s important to adjust your budget accordingly.

Now that you're familiar with budgeting, you’re ready to make your budget for high school and beyond. Whether you’re a beginner or a seasoned professional, student budgeting worksheets serve as a roadmap for managing your finances. These worksheets will help you to distribute your funds wisely, avoid unnecessary expenses, and work towards your financial goals. If you haven’t done so yet, be sure to download our budget worksheet PDF. Happy budgeting!

WHAT'S NEXT?💲A budget can help you manage any amount of money-- even a sum as large as one million dollars. Read how 10 Students Answer 'What Would You Do With a Million Dollars?'. 👛Sticking to your budget is a great habit to develop as a student. Learn the other ways to Build Better Money Habits in College. |

.jpg)

.jpg)